Roblox vs. The Hindenburg Report: Separating Fact from Fiction in the $180B Gaming Industry

Our analysis of Roblox provides context to Hindenburg's allegations, examining the platform's financial positioning, partnerships, and future prospects.

Analyzing Hindenburg's Claims and Roblox’ Future Potential

In the wake of Hindenburg Research's recent report on Roblox, we've conducted a thorough analysis of the company's investor relations reports, analyst coverage, and the allegations made. Our conclusion? Hindenburg's report is inflammatory, unfair, and largely untrue. Here's why:

Examining Hindenburg's Motives

Hindenburg Research, a well-known short-seller, has a history of profiting from its reports. The company often investigates firms in which it holds stocks, shorting them before publishing potentially damaging information. This practice raises questions about the neutrality and bias of their findings. Case in point: Roblox's stock took a 4.6% dive following the report's release last week.

User Engagement: Beyond the Numbers

Roblox reports approximately 79.5 million daily average users (DAUs). Hindenburg accuses the company of inflating these numbers by up to 42% by including multiple accounts per individual user. However, Roblox has been transparent about its methodology, acknowledging that DAUs "are not a measure of unique individuals accessing Roblox." The company also asserted that developers have been known to create bots to make individual games appear more popular than they are.

Even if we consider Hindenburg's claims, Roblox's user base remains impressive.

As noted by industry expert Matthew Ball, "Compared to its most similar competitors—the social virtual world platforms, Minecraft and Fortnite—Roblox has about 5x and 2.25x as many monthly players." Even with potential inflation, Roblox would still boast 2.2x as many players as Minecraft and 1.4x as many as Fortnite.

Each month, players spend close to six billion hours using Roblox, over 2x more than Disney+. Even if we reduce the number by 30%, as Hindenburg suggests, the attraction of a game space for story-telling and story-living suggests that the future of media is interactive, social, and gamified. In this respect, none of the other gaming or media franchises quite compares.

Child Safety: A Priority, Not an Afterthought

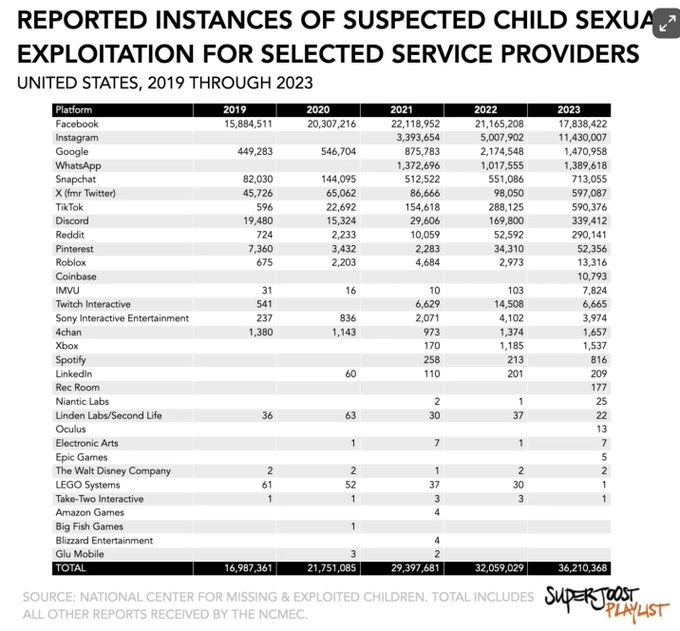

Hindenburg's report included serious accusations regarding child exploitation on the platform. While content moderation is an ongoing challenge for any social platform, recent data from the National Center for Missing and Exploited Children (NCMEC) suggests that Roblox, while not perfect, is far from the worst offender. In fact, 10 other popular social media platforms scored worse in terms of child safety.

Our firsthand experience working with Roblox on a branded game experience revealed a consistent and high commitment to child safety. The company continues to invest heavily in AI moderation bots to monitor, report, and reduce malicious behavior. Anecdotally, we’ve played the game for two years and never encountered the malicious behaviors frequently experienced on other gaming platforms.

The Roblox Economy

Roblox's impact extends far beyond its user count:

Engagement: Users spend nearly six billion hours on Roblox monthly, over twice the time spent on Disney+.

Creator Economy: In 2022, users designed 170,000 virtual items and 15,000 virtual worlds daily.

Economic Impact: Roblox distributed $803 million to its global creator community in 2023.

Financial Health and Future Prospects

Despite Hindenburg's attempts to sow doubt, Roblox's financial fundamentals remain positive:

Cash Flow: The platform has been cash-positive for at least 24 quarters, with $650 million in c

ash flow (roughly 20% of revenue).

Growth: Average bookings reached $955.2 million, up 22% year-over-year.

Ambitious Goals: CEO Dave Baszucki aims for 10% of all gaming content revenue and 1 billion daily active users.

Profitability

Roblox's cash flow is increasing year-over-year and has been cash-positive for at least twenty-four quarters. The platform is cash-positive, with $650MM, roughly equivalent to 20% of revenue.

The platform’s main challenge is its cost structure which is burdened by high platform fees (30%), developer payouts and R&D. Platform fees may be mitigated somewhat by the Digital Markets Act in the EU which has the potential to make app side loading a viable alternative, lowering the burden of platform fees. Average bookings at $955.2 million, up 22% year-over-year could be improved.

Strategic Partnerships Fueling Growth

The past few weeks have seen Roblox forge powerful alliances:

Shopify: A new partnership with Shopify Inc. will allow users to sell digital and physical products through Roblox gaming experiences.

WPP: A collaboration with WPP aims to unlock new opportunities for consumer engagement, particularly with core Gen Z and Alpha demographics.

Ricardo Briceno, chief brand officer of the Roblox studio Gamefam says top agencies ‘recognize the value of a metaverse plan for brands within the overall media strategy mix,”

He says “the reach that Roblox can grant their clients with a key Gen Z and Alpha audience will result in further brands entering the space.” We fully agree.

Activating the platform more vigorously in Asian and European markets would scale Roblox faster. These global partnerships should help.

The Bottom Line

While Roblox faces challenges, including high platform fees and R&D costs, its position as a cultural powerhouse and gateway to the world's largest spending block —Gen Z and Gen Alpha— remains strong.

With 3.4 billion global gamers and an industry generating over $180 billion annually. Roblox CEO Dave Baszucki’s stated goal to reach 10% of the global gaming market's revenue and a billion daily active users is ambitious, but not unrealistic. The platform’s combined popularity, profitability, and partnership strategies are on the right track.

As the lines between gaming, social media, and e-commerce continue to blur, Roblox stands at the forefront of this convergence. Despite short-seller attempts to discredit its success, Roblox's continued growth and cultural significance with young audiences position it as potentially the most impactful social platform since early Facebook.